Time Frame Daily

Currency pairs:any

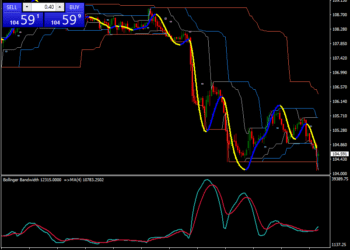

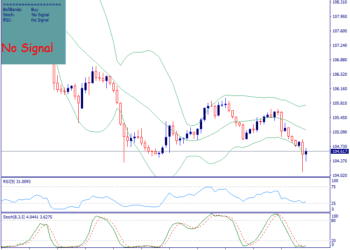

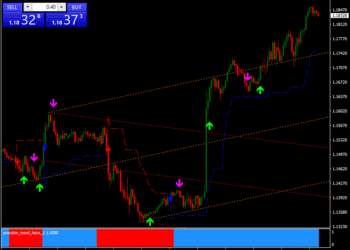

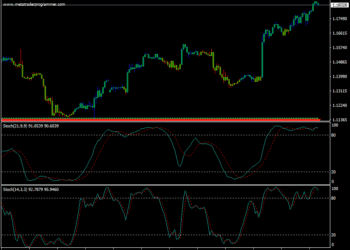

The rules we set for entry are very simple. We look for when the RSI crosses its

moving average. Picture illustrates when a trade is on.

We BUY when RSI crosses themoving average from below (green box and line) and SELL when it crosses fromabove (blue box and line). It is vital to note that a cross is only validated after the

daily candle has closed. We don’t take a trade on the day when the cross has formed

as it may disappear later in the day.

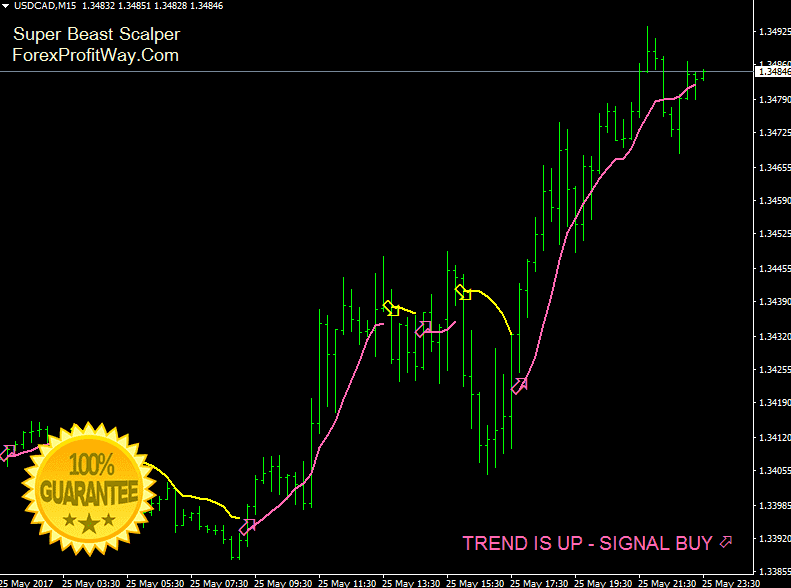

We enter the trade as soon as the new candle is formed i.e. at the opening

price.

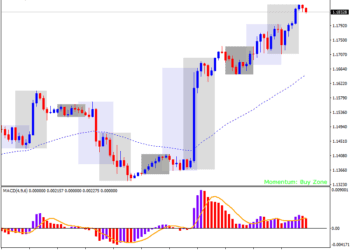

Exit

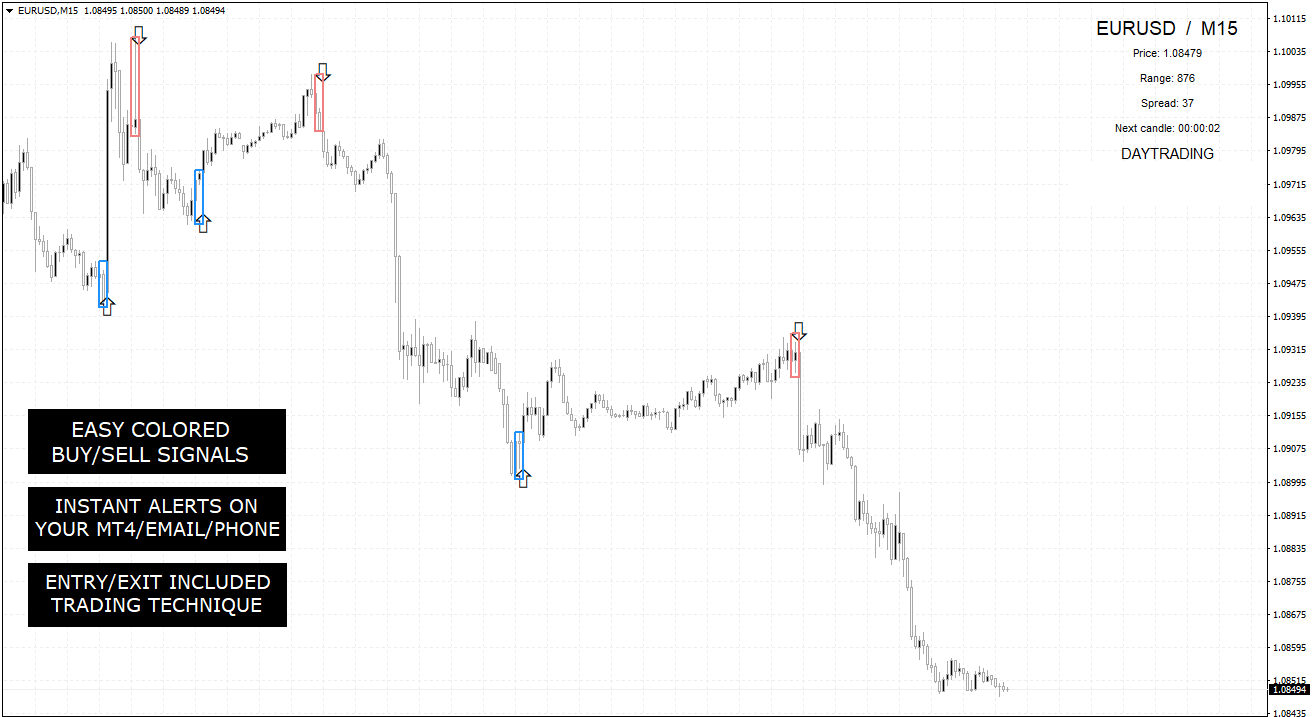

One, and a powerful one which has proved very effective for me, is using a

percentage of the ATR (Average True Range). The ATR shows numerically howvolatile a currency has been recently. A small ATR (30-50 pips) shows the daily

ranges have been small, this currency pair is moving very little.

A higher ATR (100-

200 pips) shows a currency pair on a rollercoaster ride, either in a strong trend or

ranging wildly.

Obviously for a high ATR we need a bigger stop to give the trade some room to

breathe. (for more see pdf)

or

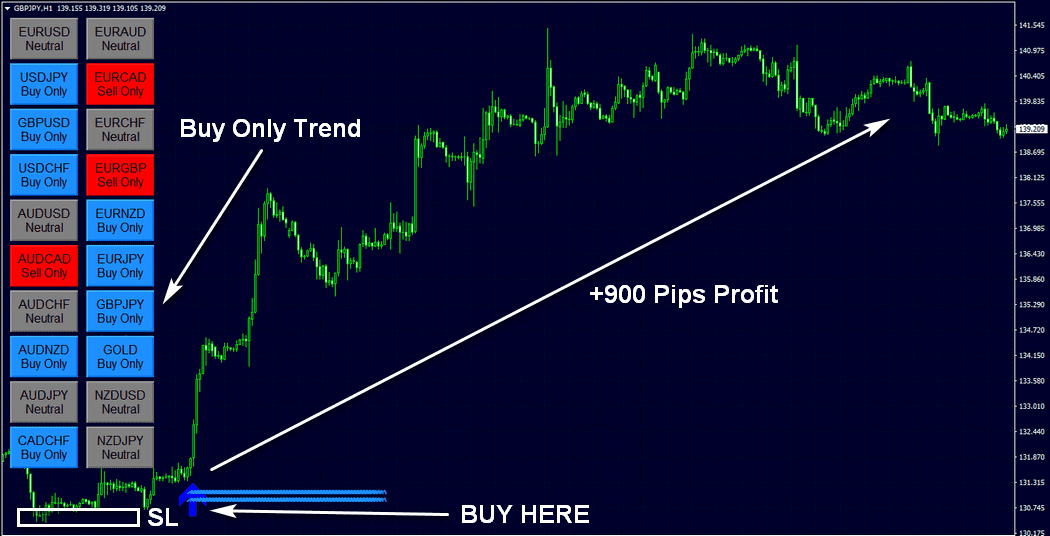

Related Mt4 Indicators

Directional Key Trading System for MT4

Forex Wave Trading System for MT4

Don't Miss Pro Indicators And Trading Systems