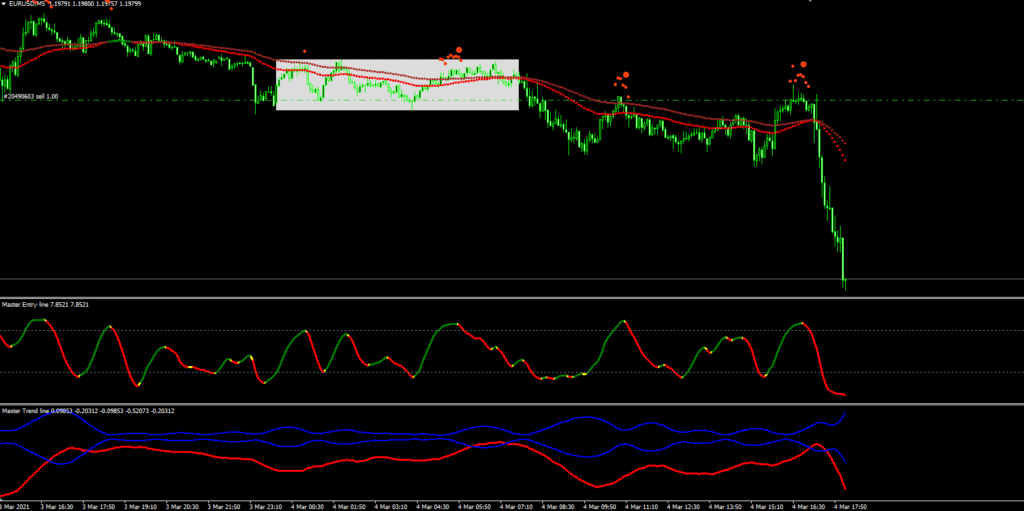

Free download forex delphi scalper trading system for mt4

Forex Delphi Scalper Framework

Presentation

Welcome to the Forex Delphi Hawker Framework!

You are presently holding the absolute most precise and beneficial Forex scalping framework I have ever created (or even seen, besides) in my whole exchanging vocation. It’s a framework I exchange for all intents and purposes each day in my own

account, and I’m certain that you will discover it as gainful and enjoyable to exchange as I have.

The motivation behind this manual is to give you the ins and outs of the Delphi so you can start exchanging it quickly with certainty.

However, before I dive into the particular subtle elements of Delphi Hawker, we should first touch on precisely what scalping is and why it is so capable.

(NOTE: In case you’re a more propelled dealer and are now acquainted with scalping, you can don’t hesitate to avoid this next area… )

Why Everybody Ought to Figure out how To Scalp…

Dissimilar to more conventional exchanging techniques, for example, “swing exchanging” and “purchase and hold”…

The mission of the “Hawker” is to take Numerous little benefits on little developments different times each day, amid particular snippets of “unsurprising unpredictability”.

I’ll clarify what I mean by “unsurprising instability” somewhat later in this manual, however for the time being everything you need to know is that scalping (when done accurately) is represented by extremely strict tenets in light of the fact that the room for mistakes are so tight. In this way, in case you’re the sort of broker who likes to be a “free thinker” and fly-by-the-seat-of-your-jeans…

I’m sad however you’ve gone to the wrong place.

1. Hawkers encounter less long haul hazard presentation. Longer-term speculators, swing merchants and even dynamic informal investors with open positions are liable to everything from erratic news declarations, crevices toward the begin of new sessions and even false breakouts and unexplainable “whip-saws”.

But since hawkers are in and out of exchanges rapidly, it’s for all intents and purposes difficult to have one “unfortunate” exchange explode a whole record.

Consider it like this…

You can be the world’s most unfortunate blackjack player, however in the event that you just play at the $5 tables, it’ll take you a ton longer to become penniless than if you playing the $500 tables. (What’s more, who knows… perhaps that additional the truth will surface eventually exactly what you have to turn your “good fortune” around… )

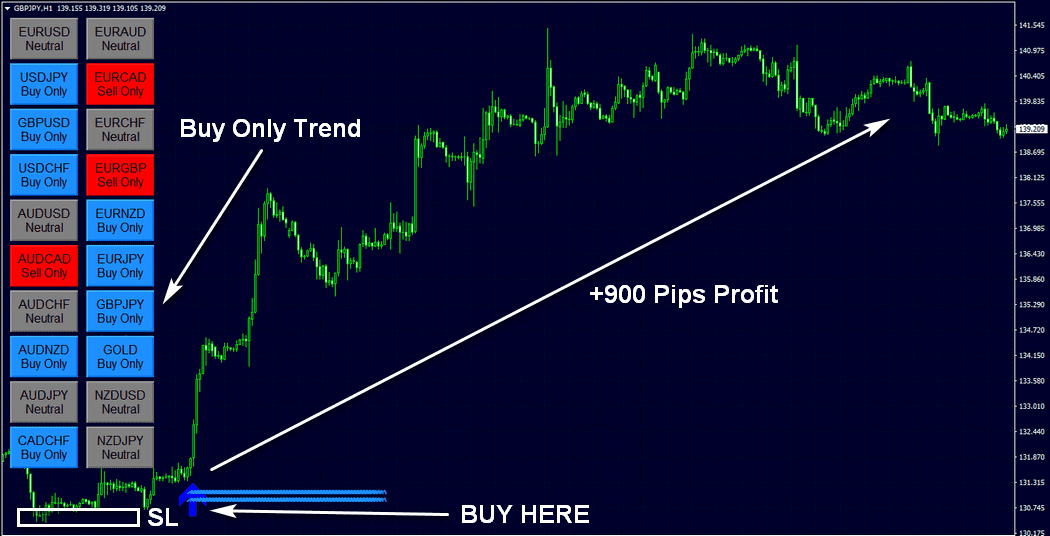

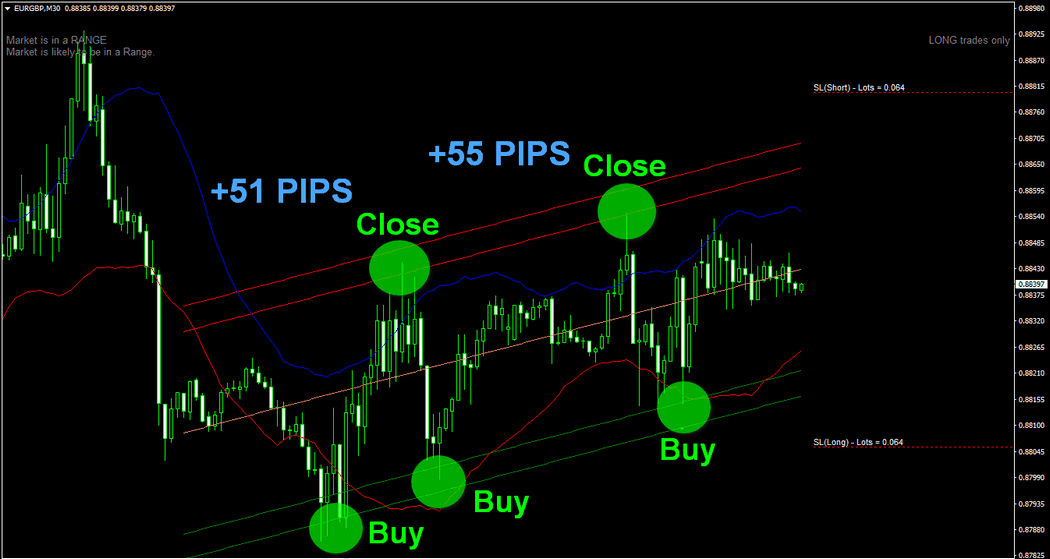

That is the way it is the point at which you’re scalping! Since you’re just hoping to scalp 10, 20 or 30 pips at once, you’ll be keeping your stop-misfortunes ultra-tight and in this manner restricting your most extreme per exchange introduction. Goodness better believe it, and when you’re scalping with Delphi, you’ll never feel like an “unfortunate” merchant. Truth be told, you’ll be stacking the deck to support you like a prepared Vegas card-counter…

2. Scalping is a considerable measure of fun! Let’s be honest, exchanging isn’t just about developing your record size… it’s likewise about having a ton of fun! Keeping in mind it can be “fun” to watch your record grow a tad bit each week by exchanging only a couple of minutes a day, in case you’re similar to me you appreciate the Activity and Fervor that scalping brings.

So regardless of the fact that scalping isn’t your essential exchanging style, it’s still an incredible approach to supplement longer-term exchanging styles that honestly can get somewhat drained and exhausting.

Why Scalping The Forex Is Distinctive?

Scalping was initially used by securities exchange dealers who acknowledged they could get in at a representative’s distributed Offer or Solicit (contingent upon the bearing from the exchange), and in light of what individuals were willing to pay for the stock the

broker could sell the position inside of minutes or even seconds to take the distinction in Offer and Inquire.

Each of these exchanges returned a little measure of benefit, which in principle, could be rehashed. By “scalping” out divisions in a speedy measure of time, a gifted dealer could become a significant record equalization if these little developments were utilized appropriately.

It sounds sensible, isn’t that right?

Furthermore, it was sensible… back when stocks still exchanged divisions (and not decimals) and commissions were modest.

Be that as it may, in the Forex market where 3 and 4 pip spreads are regular, this “rationale” just doesn’t hold water.

That is the reason, with regards to scalping, I have an alternate definition than a large portion of the conventional hawkers would tote. In the event that you ask any “old school” hawker, you would more than likely get a really nonexclusive meaning of what

scalping is today.

For the most part, hawkers today concur that “present day scalping” is to just be in the business sector for a couple of minutes or seconds, pulling just 1 or 2 pips out of the business sector at ultra-high influence to make “snappy money”.

Be that as it may, I deferentially can’t help contradicting this definition…

As far as I can tell, the meaning of scalping in the Forex should be widened a considerable amount…

Rather than hauling 1 or 2 pips out of the business sector, I search for 10 – 20 pips…

Also, rather than just being in an exchange for a matter of seconds, I’m commonly in exchanges for no less than a couple of minutes.

Also, the explanation behind this is straightforward…

The expense of scalping in a high-influence environment like Forex (we will get into this somewhat later) can be really impeding. The danger to remunerate basically isn’t justified, despite any potential benefits going for just 1 or 2 pips.

On the off chance that a coin pair has an entire 3 pip spread, then you are as of now negative by 3 pips Promptly after setting the exchange. When you begin down 3, you require the money pair go toward you for an aggregate of 4 full pips

JUST to make 1 pip. It simply doesn’t bode well from a scientific point of view.

Basically, you aren’t going to profit doing “outdated scalping” over the long haul in the Forex. There might be those individuals out there who will let you know generally, however believe me… it just isn’t doable.

Likewise, there is the subject of how fast the Forex markets move amid crest hours (when scalping will customarily happen). The Forex markets are a tremendous and unpredictable working environment – most dealers will observe that getting out

of an exchange by hand at precisely the cost you’d like without a stop misfortune or take benefit can be for all intents and purposes incomprehensible.

There are robotized programs that can offer you some assistance with achieving this level of pace and accuracy, yet shouldn’t something be said about when your merchant slips your request by 2 pips? Also, when 1 or 2 pips implies the distinction between a benefit or a

misfortune, I’d rather adhere to my “10 pip least” mantra. It has kept me productive for quite a long time, without the heart assault of thinking about whether each and every exchange will go south on me before the request even closes.

Donwload Now

or

tags: free forex indicators , forex trading system , forex trading strategies , forex indicator

Don't Miss Pro Indicators And Trading Systems