Should we do trading by Fundamental Analysis or Technical Analysis?

This is the most common question asked by the novice traders when they start trading in the stock market.

Both methods are used for analyzing the future price movement of the stocks based on past data.

But the main goal of Fundamental Analysis is to find the intrinsic value of whereas the main goal of technical analysis is to find the upcoming trend of the prices of the stocks.

Before we drive into the difference between fundamental and technical analysis, let us understand what they mean

What is Fundamental Analysis?

The main aim of fundamental analysis of stocks is to find the intrinsic value of the company.

By intrinsic value, we mean finding out the fair value of the stocks we hold. This helps us in determining whether the stock is overbought or oversold.

Some economic factors need to be taken when determining intrinsic value.

Here are the steps of conducting fundamental analysis:

- Macroeconomic Analysis: This involves studying macroeconomic factors like interest rate cycle, capital flow, geographical and political factors.

- Industry Analysis: This involves studying the industries of the same sector.

- Situational Analysis: This involves studying the factors impacting the business of the company.

- Financial Analysis: This involves studying the annual and quarterly reports of the companies.

Financial Analysis is also known as the quantitative analysis, it mainly involves studying the financial statements of the company and analyzing how the company has performed in the past and how is it going to perform in the future by estimating the values.

One should also analyze the qualitative factors of the company that involves analyzing the management of the company, promoters, the stake of the promoters in the company, etc.

Now, let us come to technical analysis:

What is Technical Analysis?

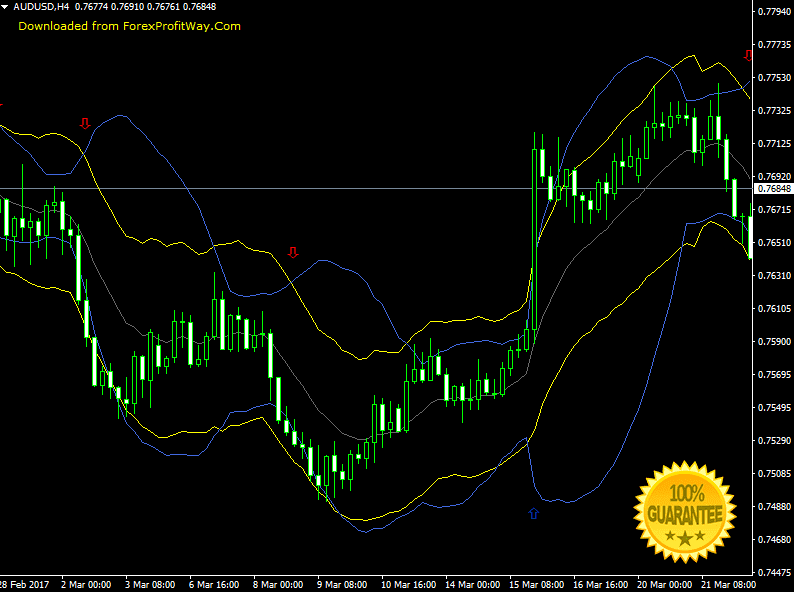

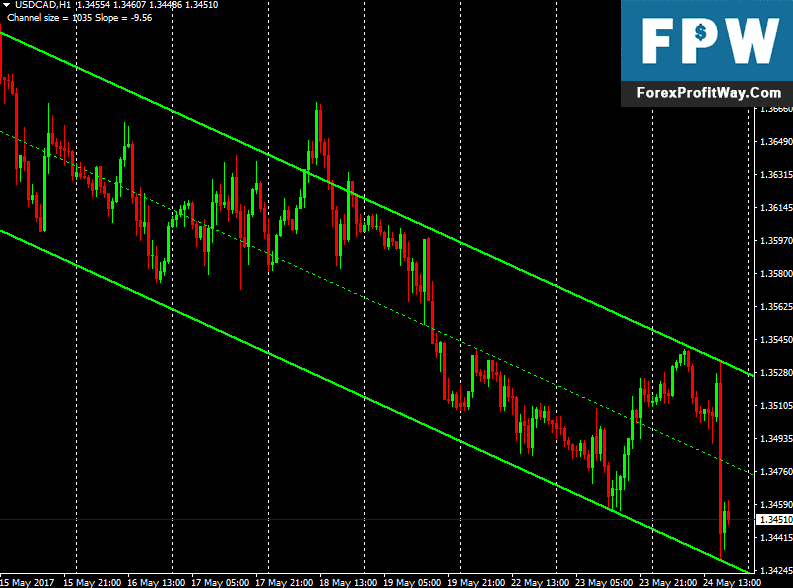

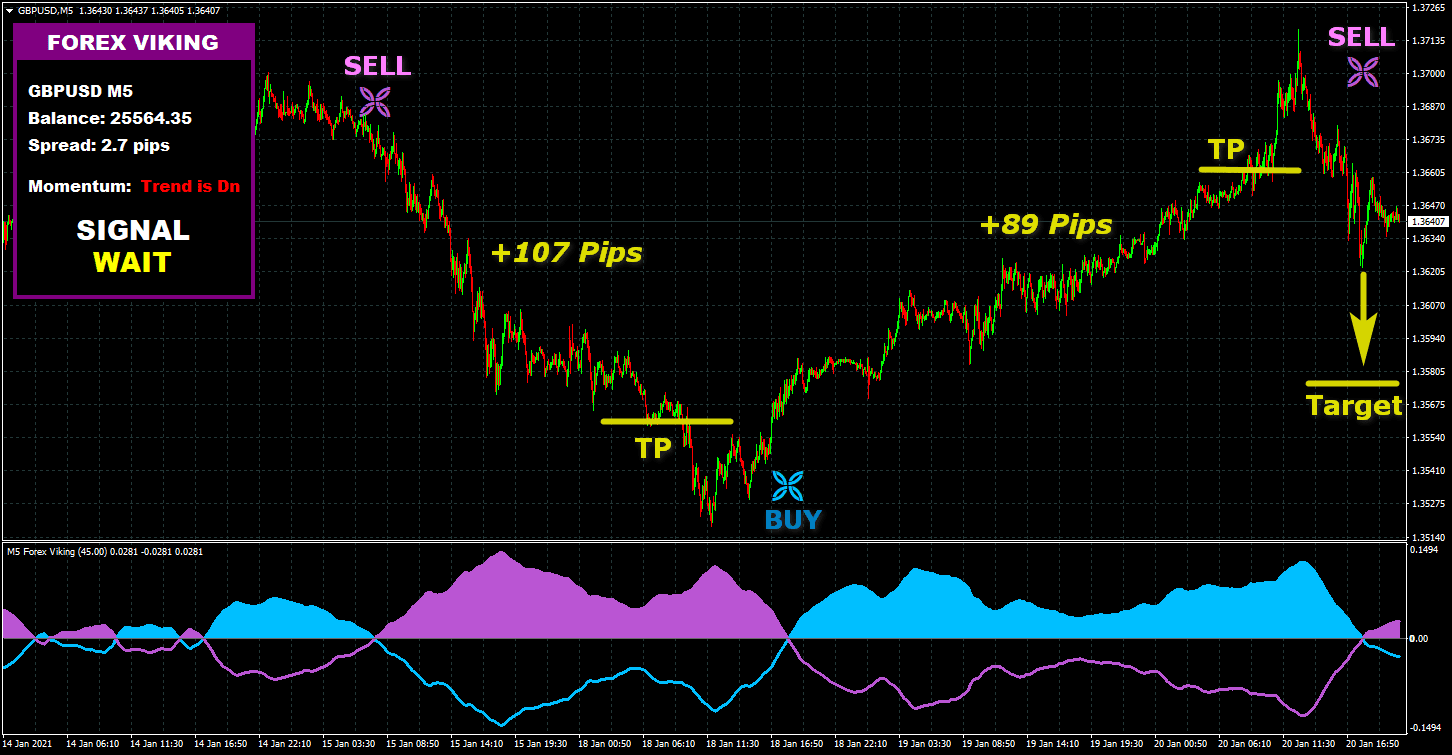

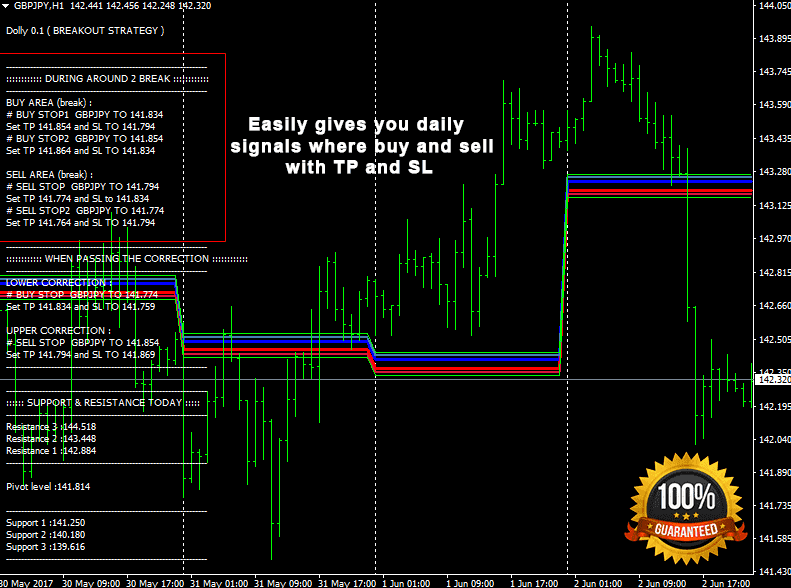

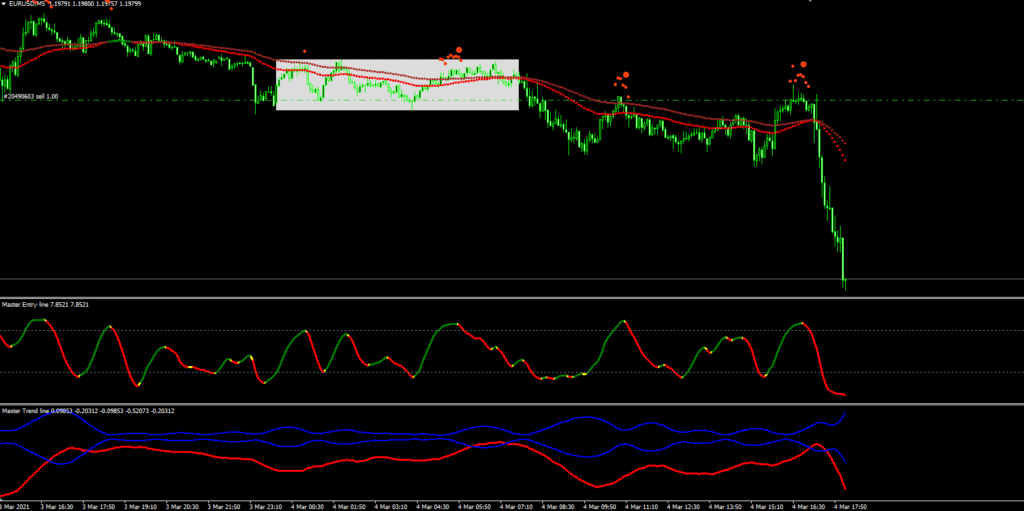

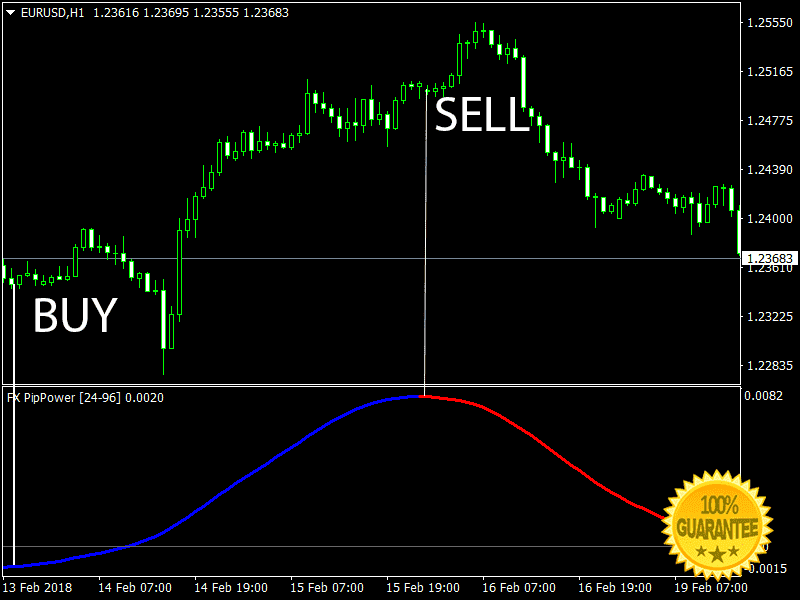

Technical analysis is based on analyzing the price movement on the charts.

Traders can assess the future price movements by plotting stock information like prices, volumes, and open interest on the chart.

Many technical tools help us in gauging future price movements like technical indicators and chart patterns.

Technical indicators can be further classified into leading and lagging indicators.

Leading indicators are those which lead the price movement and signal the continuation of trend or reversal.

Whereas lagging indicators are those which lag the price movement and confirm the ongoing trend.

Here are some basic assumptions of technical analysis:

- Prices tend to discount all information that is available in the market.

- Price movements are not random and moves it trends

- Price Trends repeat themselves.

Having known about the basis of both fundamental and technical analysis, now let us discuss the differences between them:

Difference between Fundamental and Technical Analysis:

Here are the main differences between fundamental and technical analysis:

As discussed above, fundamental analysis involves finding the intrinsic value and also analyzing various factors that may impact the prices of the stock in the future.

Whereas technical analysis involves analyzing the statistical data and predicting future price movements based on past data.

We usually use fundamental analysis for long term investing, whereas we use technical analysis for short term trading say for a day, week, months, or one year.

Technical analysis examines the price movement as well as market psychology whereas fundamental analysis examines the macroeconomic and industry factors.

Fundamental analysts mainly used the financial statements to analyze the company whereas a technical analyst uses technical indicators and chart patterns to analyze the price movements.

Which one is for you?

Fundamental analysis helps us in the background checking of the company whether it is performing or not, revenues are rising or not, of the company is giving us dividends or not, etc.

With the help of this data, we can analyze if the company is going to perform in the future and invest in our hard-earned money accordingly.

If you are a long term investor and want to invest your money and take benefit of compound interest, then you can opt for fundamental analysis.

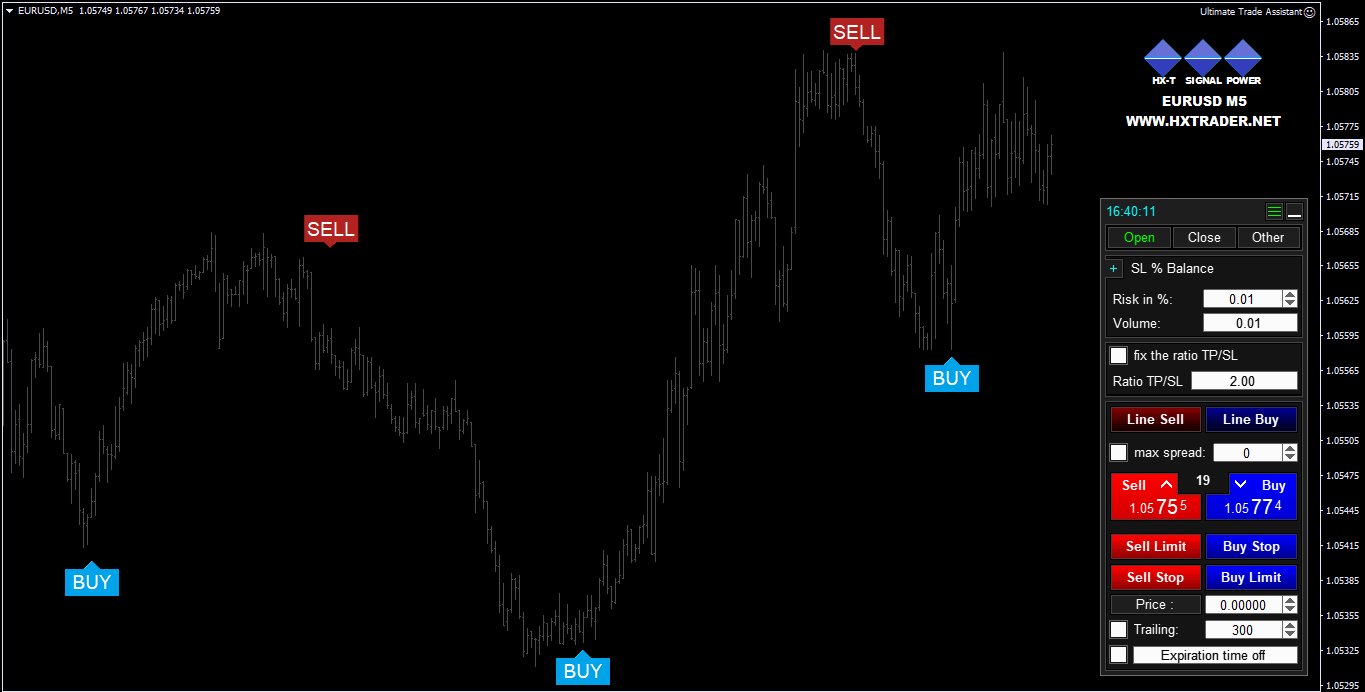

But If you want to do trading in the share market, then you can opt for technical analysis.

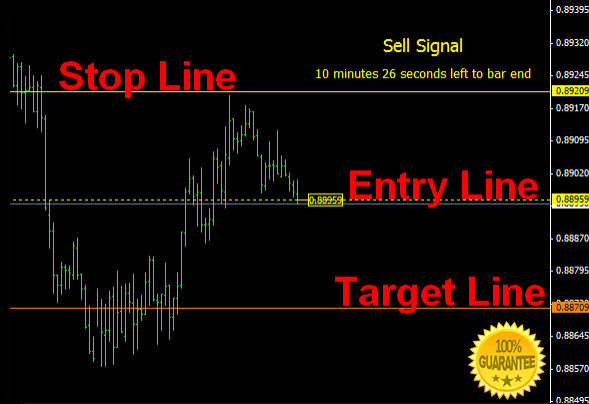

Technical analysis helps you in finding entry and exit signals and also signals if the current trend is going to reverse or not.

Basics of technical analysis can be applied to any time frame say it daily, weekly, monthly, yearly, and so on.

The technical indicators and chart patterns can also be applied to any timeframe.

You can choose for which timeframe you want to trade in the market, and start trading accordingly.

We can conclude that if you are a long term investor then you may start doing fundamental analysis of the company, and if you are a short term trader then you should opt for technical analysis.

Don't Miss Pro Indicators And Trading Systems