Free Download The Engulfing Trader Training Series Course

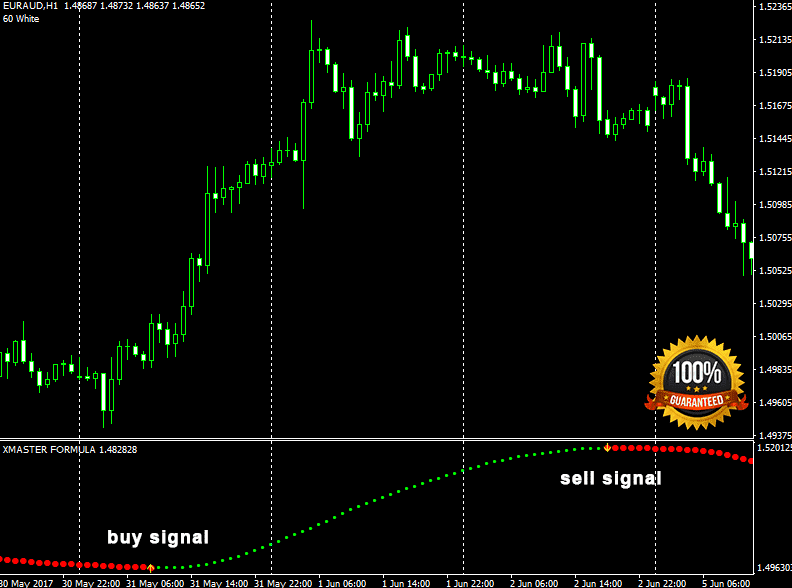

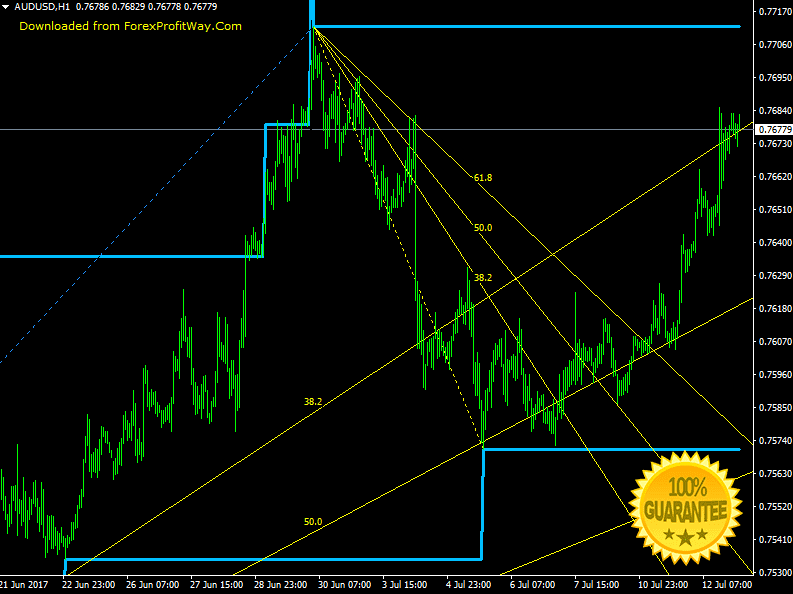

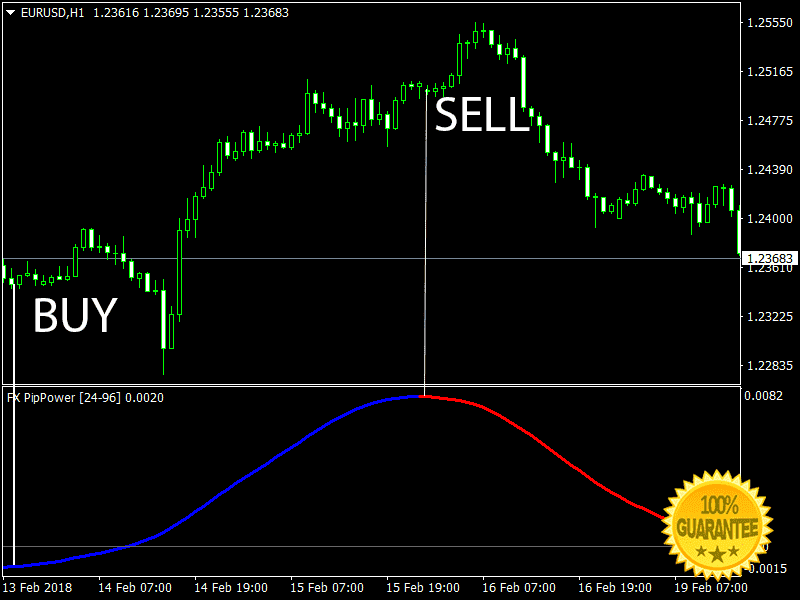

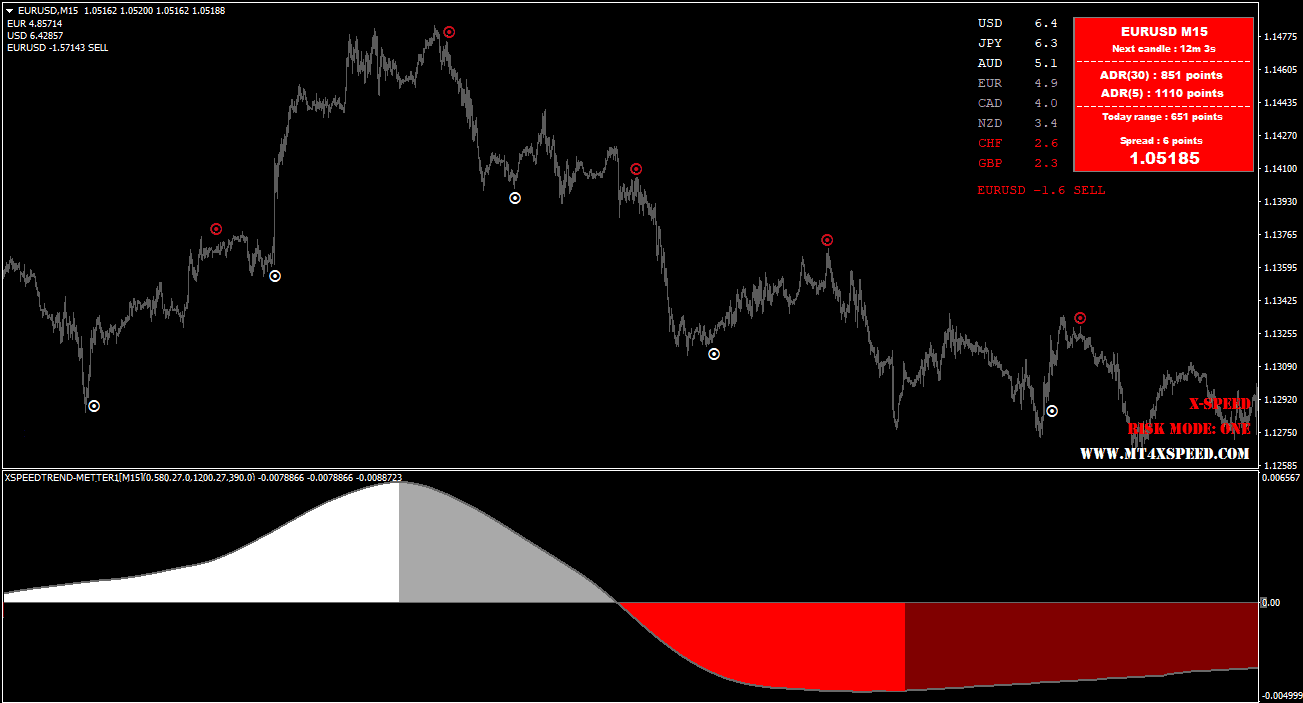

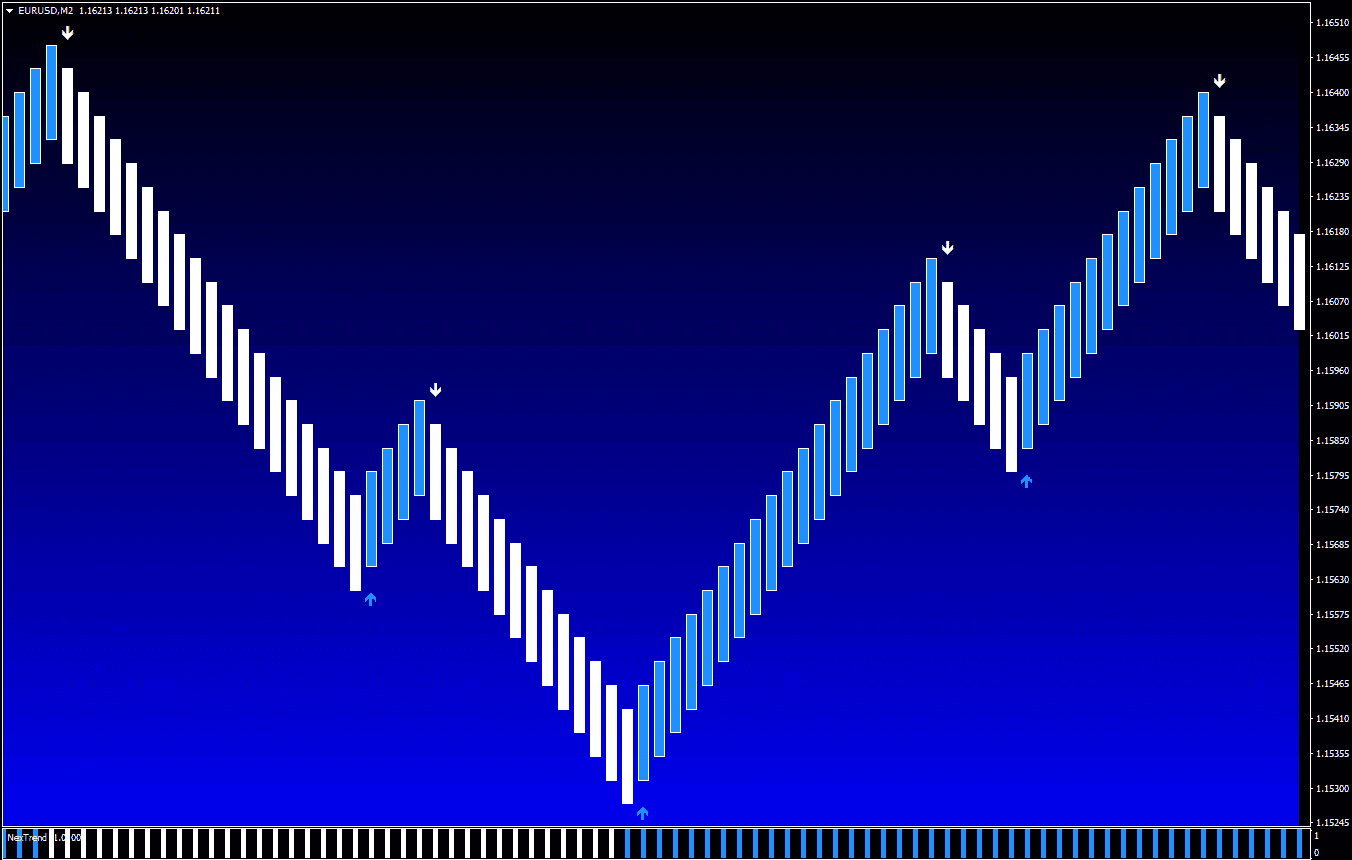

There is one element on the charts that is always there. That element is structure or what many refer to as support and resistance. To many this is a way overlooked subject.

If you are new to the Forex market or to any market it may appear like the charts are completely random. This is not true of course, structure is always there and the market in one way or another follows these points over and over again. That does not mean structure is always respected however it does give high probability areas in order to trade with Price Action where chances are in your favour. Remember trading is a probability business and structure is the way the market moves.

In order to draw structure on the charts pull up the daily chart, turn it to the line chart and look for multiple touches of one point. These areas are where you draw your horizontal lines in your MT4 or similar platform and these areas are where you want to set your alarms.

For a strong or significant support or resistance you want to see at least two or more strong touches.

As the daily chart and weekly structure lines give the best probability and reward to follow this strategy, one should draw you lines from these two time zones. (Refer to video part one)

It is also important to note that improperly drawn daily or weekly support or resistance lines can be costly to a trader, so spend time on this video part in detail. In this Part I cover in detail how to draw them properly. If you have been using an indicator for this in the past, then now is the time to discard that indicator. This part in the video shows in detail how to draw and use only high probability support and resistance areas. This aspect is a key component of trading any successful strategy.

Don't Miss Pro Indicators And Trading Systems