Before we get started, I wanted to let you know there is a booklet that you are required to read before you trade a single option. Your broker will require you to read it before you start trading. In fact they are required to give you a copy.

The booklet is called Characteristics and Risks of Standardized Options and Supplements. This booklet is designed to explain all the risks involved with options trading. It is pretty technical and you will need to go through it a few times to understand it but it is well worth the time. Here is a link to download it.

There are two types of options. Call Options and Put Options. A Call gives one the right but not the obligation, to purchase an underlying security at a set (strike) price. A Put gives one the right but not the obligation, to sell an underlying security at a set (strike) price. Although options are legal contracts it helps to think of them as something else. I like to think of an option as a coupon.

Let’s say you are thinking of buying a watermelon in the not too distant future. And you think that the price of watermelons is going to increase. So you want to lock in today’s price. In this case, I agree to sell you a coupon (option) to buy a watermelon from me for $1.00 which is today’s price. But I will charge you 10 cents for this coupon and it expires in 90 days. Let’s say 89 days go by.

Your coupon expires tomorrow. If the price of watermelons is more than $1.00 and you still want your watermelon you should use the coupon. If the price of watermelons is below $1, you should forget the coupon and just buy a watermelon at the market price. This will allow the coupon to expire worthless and I would make a nice profit of 10 cents.

But what if you didn’t want the watermelon but the price went up to $2. You could either buy the watermelon yourself using the coupon and sell it to someone else for $2, making you a nice 90 cents profit. (Remember you paid 10 cents for the coupon.) Or you can sell the coupon to someone else, for $1, also making you 90 cents. Either way you win, and I lose. It’s the same with stocks. Thousands of stocks, indexes, and ETFs have options available to trade.

Options are gaining in popularity because of the immense leverage. In our example, all you have to invest was 10 cents to control $1 worth of watermelon. Let’s look at our example above again. You buy an option for 10 cents, and you later can sell that option for $1 making you 90 cents. That’s a 900% return on your money.

If instead you had bought a watermelon at $1 and sold it later at $2, you would have made $1, or 100% return. 100% is great, but not compared to 900%. In our example the coupon you bought was a Call option. If you had thought the price of watermelons was going down, you could have bought a Put option. Put options gain value when the stock Calls make money when the underlying stock goes up. Puts make money when the underlying stock goes down.

Call me UP. Put me DOWN. Let’s move on. When talking about an option there are 3 classifications to be aware of: In the Money, At the Money, Out of the Money. In the Money If a stock is trading at $50 the $45 Call the option is in the money by $5 as it has to have $5 of intrinsic value. At the Money If a stock is trading at $50 the $50 call is trading at the money.

Out of the Money If a stock is trading at $50 the $55 call is out of the money. Expiration As you saw earlier in the Watermelon example, the coupon I sold you was only good for 90 days. That is what is known as the expiration date. All options have an expiration date. At expiration, the option will stop trading. If the option has any value left it can be exercised. That is jargon for used. Basically if you use your coupon to buy a watermelon you are exercising your option. If the option has no value at expiration, it expires worthless and basically goes away. Poof like magic.

There are many different expiration cycles to choose from. The most common are monthly options. There are also weekly options, quarterlies, and LEAPS. A LEAP is long term option that expires in January it could be next January, or one or more years away. 2 Components of Option Value Intrinsic and time value Option Value is known as Premium. Premium is made up of two sources: Intrinsic Value and Time value.

An option has Intrinsic Value only if it is In The Money. So if the strike price of a Call option is $50 and the stock is trading at $57, the option has $7 worth of Intrinsic Value. Options also have Time Value. Time Value is based on how much time left to expiration. The farther away it is the more the option buyer will have to pay for the option.

American and European Most stock and ETF options are American style options. Index options are European style. The main difference is that American style can be exercised early. European options cannot. A Short History of Options Let’s talk about why options started trading in the first place. Options were created as a way to lose money! Most amateur traders don’t realize this.

Options were created as a way to hedge a position. They were created to act as insurance. They were first introduced in the commodities space. Imagine you are a wheat farmer and you need to know what the price of wheat will be when your crop is ready to sell. Prices fluctuate all the time. As a farmer you could buy Put options on wheat as a hedge against falling prices. This way even if the price of wheat drops to zero and your crop is worthless, your Put options will make money and make up for the loss. Or take the example of a toy manufacturer.

Toys are made of mostly plastic which is made from oil and gasoline. In order for you to know your costs, you need to know what the oil and gasoline will cost in the future. If they go up too much your toys will cost too much to produce and no one will buy them. So what you do is buy Call options on Oil and Gasoline. That way even if the prices go up, your options will make money and you can use that money to offset the higher cost of materials. Since your costs of Oil and Gasoline are known in advance you can price your product properly. In both scenarios, you want to lose money on your options! You only wanted them as insurance.

No one ever wants to collect on their insurance, because that means something bad happened. Market makers and other traders are happy to sell these options because they know the odds are on their side and that the options will most likely expire worthless. So you see, both sides know that the options will expire. And they are happy with it.

Options were then introduced on stocks in the hopes of increasing trading and commissions. Boy did that pay off for the stock exchanges. But that’s when speculators jumped in and started promoting options as a way to get rich. And while it is possible to hit a home run with options once in a while, over the long term, buying options is a losing game.

If you have ever seen an ad or heard someone talking about making 1000 percent gains they are talking about buying options. In future lessons you will see why this is a very hard way to get ahead over the long term.

Download Now

or

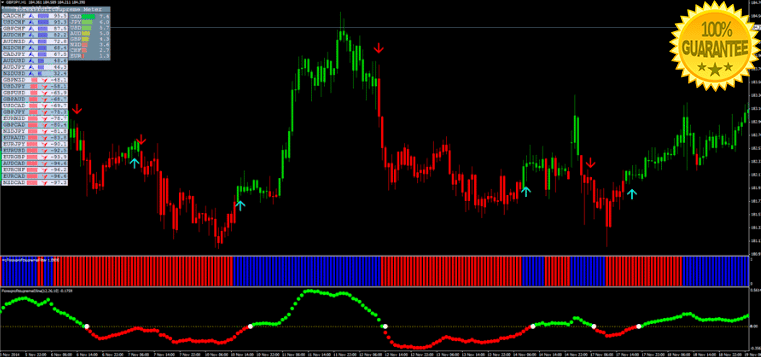

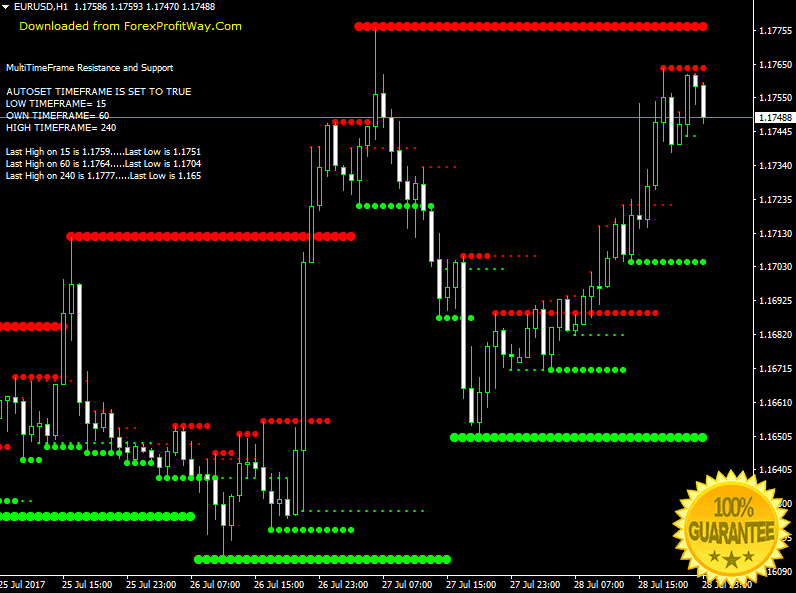

Don't Miss Pro Indicators And Trading Systems