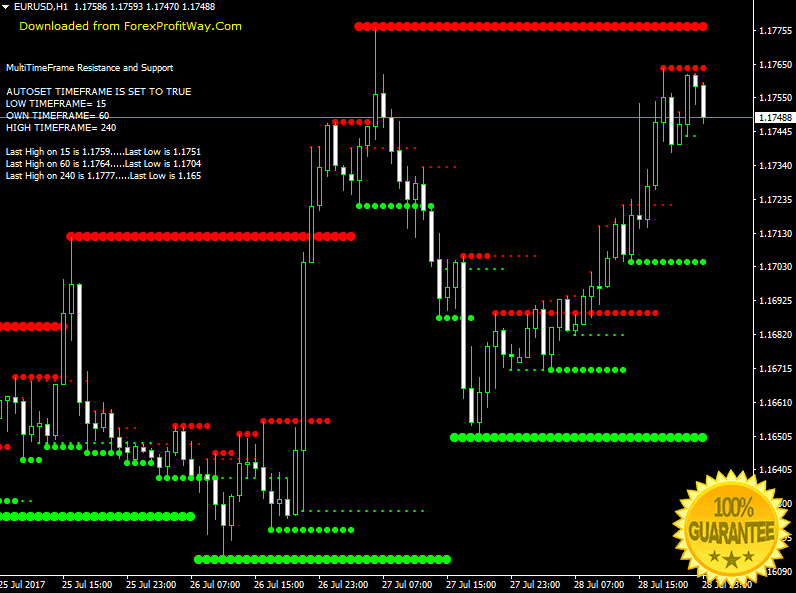

Stretch indicator uses the absolute difference value of 10 SMA between open and either the high or low, whichever difference is smaller. The indicator represents the minimum average price deviation from the open price, and is used to calculate breakout thresholds for a trading session.

Trading Strategy

According to the ORB range breakout strategy, a trader places a buy stop order just above the open price plus the Stretch value and a sell stop just below the open price minus the Stretch value. The first order triggered opens a position and the other stop order becomes the stop loss level.

In general, the sooner the entry stop order is hit the more likely the entry will be profitable. In contrary, if the stop order is not filled early, the risk increases and it becomes prudent to reduce the entry size.

Lastly, orders filled towards the end of the day carry the most risk and therefore should be avoided. This also includes times when the market is extremely volatile ahead of news releases.

Trading tip

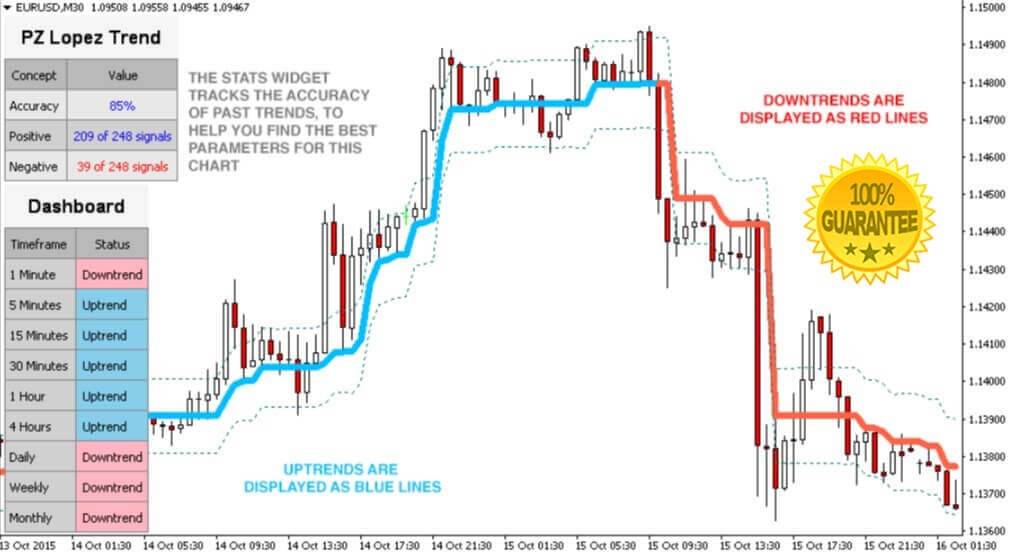

In order to increase profitability, it would be advisable to use a trend indicator such as Forex Freedom Bar indicator, which is based on CCI displayed over four time-frames, or a simple 50 moving average.

With either trend indicator pointing market’s direction, instead of placing two stop orders based on the ORB trading strategy, only one would be used to decrease the chance of market noise triggering a counter trend order.

Download Now

Password: forexprofitway.com

Don't Miss Pro Indicators And Trading Systems

![Download Trade Assistant [ Stop Guessing ] Forex Indicator For Mt4](https://forexprofitway.com/wp-content/uploads/2017/05/Trade-Assistant.png)