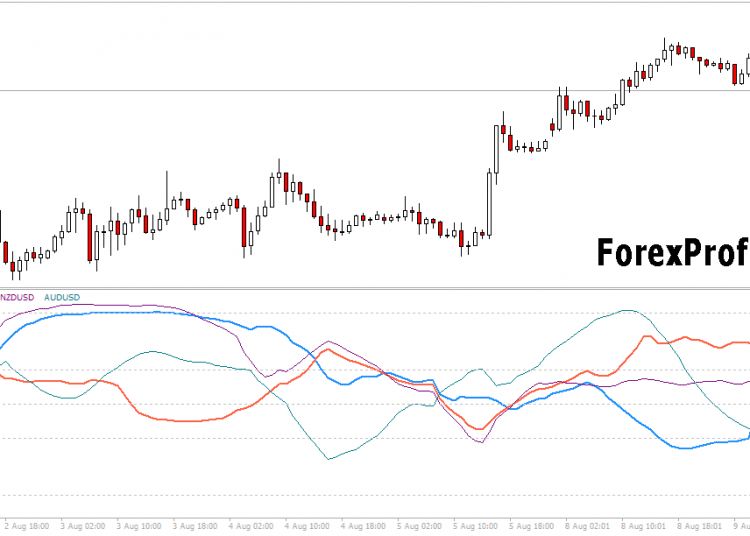

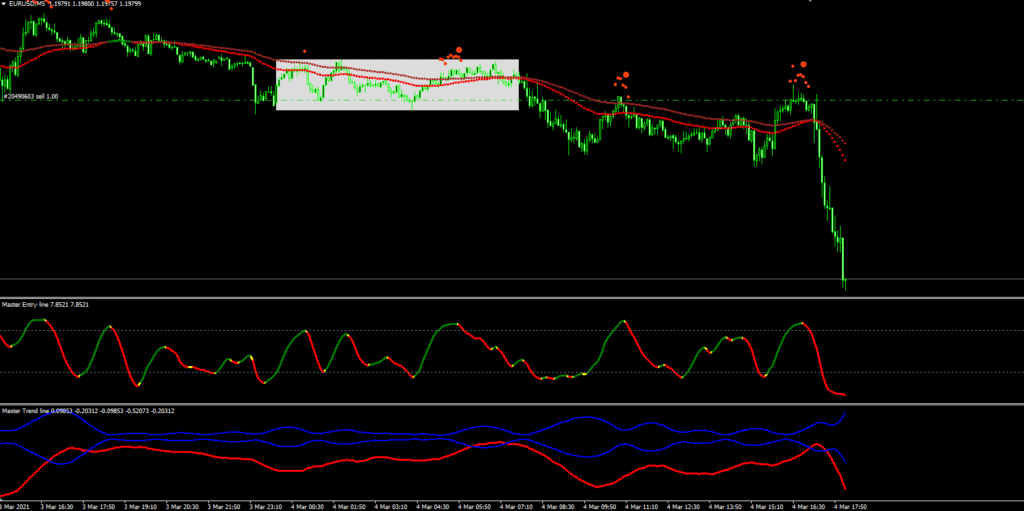

Currency Correlation indicator is used as a statistical measure to find how two or more securities move in relation to each other.

Correlations are often used for advanced portfolio management services to avoid contradicting trades and find opportunities among highly correlated instruments.

How to trade with Currency correlation indicator

Correlation is displayed as positive when two securities appreciate in price and negative when they trade in opposite directions.

A coefficient of 0 means neutral correlation.

A coefficient of 0.3 and -0.3 means low positive and low negative correlation respectively.

A coefficient over 0.8 and under -0.8 implies high positive and high negative correlation accordingly.

Therefore, for example while trading USDJPY if XAUUSD and USDCHF are positively and negatively correlated accordingly (note the position of USD in the instrument names) we could expect a reversal in USDJPY for the correlation to resume.

Download Now

or

Don't Miss Pro Indicators And Trading Systems